🛖 "Real estate market" vs "Inflation"

How does the inflation affect our real estate market? How does Latvia look in comparison to other markets? Does it make sense to buy? Let's look into this.

👋 Intro

The real estate market has always fascinated me - it feels so simple, yet it gets super complex as you go deeper into the rabbit hole. & If we believe in an incredibly old A. Carnegie quote that “90% of all millionaires become so through owning real estate”, then it’s definitely an industry to keep up with.

I wonder what will be the impact of rising inflation on the Latvian real estate market. What has happened in the past? How do we look in comparison to other European markets? Is the market overheated? Let’s dig!

🏰 Where do we stand as of July 2022

Global real estate market

We will get to Latvia in a moment, but let’s start with a quick summary of where the larger markets stand at.

The U.S.

Demand for residential real estate has decreased, and construction of new homes is slowing. Real estate companies, including Compass and Redfin, and Zillow, as well as mortgage lenders, like Wells Fargo, have laid off employees in anticipation of a housing downturn.

Sounds bad, but actually it is not that bad if we look at a longer time frame for most of those indicators. And yes, everything is going down, but it was red hot for a couple of years, so nothing too shocking there. Probably even healthy.

The scarier part for me is the home prices that have skyrocketed, even if we do the zoom-out thing & look for a longer time period, see chart below. I am pretty sure that many have pulled the trigger & bought the properties with the new price tag.

The average home price has jumped from around $300k to $400k in just a couple of years, that’s more than 30%. Sure, the income has grown as well, but not to those levels. It’s scary because (a) average 30-year mortgage rates are up to 5.3% vs around 3% for the last few years, (b) they will climb higher, and (c) energy prices jumped. So, the purchasing power has actually decreased, while property prices have gone the other way.

You can use my Tacklin inflation sheet to play around to see the impact, but it’s significant.

China

This market is definitely a tougher cookie to crack. Most important things that are happening:

“An official index that tracks apartment and house sales has posted year-on-year declines for 11 months straight—a record since China created a private property market in the 1990s.” However, once again we are talking about a drop from all-time highs. See the chart below.

“Sales at China’s largest housing developers fell 43% in June from a year earlier, according to China Real Estate Information Corp., less than the previous month’s 59% decline.” There is a month-over-month (MoM) improvement, yet still pretty bad compared to the previous year. I would say that the Covid effects are still strong - both demand last year & lack of demand now. See the chart below.

This one is an interesting fact that shows the importance of the real estate sector for China: “Demand for services and commodities generated by housing construction and sales account for about 20% of gross domestic product.”

Another interesting thing going on is people boycotting mortgage payments on unfinished home projects, more specifically stalled projects.

Evergrande, the largest developer in the country for more than a decade, failed to repay interest on its off-shore debt back in December 2021. Their total liabilities are over $300 billion & it’s speculated that there are more than $100 billion off-books. The latest is that they are also failing to pay their local liabilities as they did not get an extension.

There is an estimated 50 ghost cities in the country. Not like the friendly ghost Casper type of cities, but a phenomenon where there are actual cities that are vacant. They are not abandoned, just nobody has ever lived there. This has been going on for years & probably was necessary to keep up the construction sector’s growth.

Anyway, I have no ideas, where this market is heading. Everybody thought that a bubble is gonna burst already nearly 10 years ago when I worked as an analyst. Still has not realized.

Europe

Helicopter view

I am not gonna go there country by country as that would take way too much of our time, but here go some interesting facts that underline the differences across the region.

Household debt to income varies significantly across different markets. It’s in the range from 30% - 208% with the Euro area’s average being 97%. The leader is Norway with the aforementioned 208%, tbh no clue how you get there, but I suppose something market specific. And in the last place *drumroll* we have nobody else than our very own Latvia with 31%. It’s not that shabby to be last in this one.

Another interesting point is the median salary across the region. They vary from €363 in Albania - €4,941 in Switzerland. Unfortunately, our dear Latvia is doing pretty poorly here with €740 which positions us in 23rd place out of 33. For comparison, Estonia is sitting comfortably in 15th position with €1,084.

European house price and sales index

To check the European housing market, we will use the House price and sales index which monitors the expenditure by the private sector for acquiring a residential property. And then compare it with wage growth as one on itself it does not say that much. This does not include the construction of new housing, that’s a different topic for another day.

Let’s look at the general trends. Below you can see a chart for the Euro area and the correlation in-between housing prices & the average wages. I would see that it looks almost healthy and there are no obvious red flags. However, at least I see a slight uptick with the housing prices nearing the income starting from the year 2016 & then again around 2021/2022. Do you know what also started in 2016 & was restarted in 2021/2022? Europe’s quantitative easing program with a goal to bring inflation back to 2% 🐒 🙈

I guess it could mean that the prices are on average a bit inflated, but as said before it looks fine in general across the area. Let’s transition to Latvia & dig deeper without over analyzing other countries.

🇱🇻 Latvian real estate market

Latvian house price and sales index

I feel like a good starter to have an overall feeling is taking the same house price and sales index chart and look at Latvia. The trends that we can get out of this:

The 2007/2008 year crisis looks obvious with today’s eyes as there is a clear mismatch between income & housing prices. Unfortunately, the housing data starts only in 2006, but I have a feeling that they were below the wage line.

As of today, thankfully we are not near to anything like that. However, the prices have started to pick up already from 2015 & near 2020 they have overtaken the wage growth. To me it means one of the following things: (a) the real estate market is starting to heat up too quickly compared to the wages or; (b) the Latvian market is becoming more mature & this might be the trend in other European markets. Let’s pick a couple of markets to understand whether it could be the (b).

Fast forward to a quick summary of what I found:

Estonia & Lithuania - had similar trends as Latvia back in 2007/2008; maybe a bit less crazy. As of now, Estonia is following a similar suit as Latvia, the difference between wage growth & housing prices seems even steeper, with housing taking off this year. At the same time, even though Lithuania seems to have the craziest growth for housing, their wages are keeping up with that.

In the land of opportunities, Poland, we see a similar trend as in Latvia and Estonia, namely the property price increase is larger than the wage growth.

Germany seems like a really wild market. The property prices have jumped almost two-fold since 2016 & the salaries are not keeping up with that even though they are gradually growing.

The Netherlands has also had very steep growth since 2020, well not German steep, but I guess work from home hit off strong here.

Italy seems to be one of the few reasonable markets, with a very slight price increase for properties. Maybe they still have vivid memories from the previous crisis.

I checked multiple other markets, but the trends are very similar - the housing prices are raising quicker than the salaries. This could be driven by the working-from-home (WFH) trend as people are seeking larger properties & maybe it even makes sense if the daily cost structure changes. For example, people tend to spend less on eating out & transportation when they WFH. Now, the challenge is that inflation came to the party uninvited and we don’t know whether the WFH trend is here to stay if we enter a tougher job market during the potential recession.

Deep dive into the Latvian real estate market

Now that we have some basic facts on what is going on here, it’s a good time to dig a bit deeper. There could be some factors that are being missed when we check the room’s average temperature:

The volume of transactions being done. For example, if the amount of deals is lower, then that may impact the data with more properties being expensive.

Regional factors. Maybe historically there were more deals further away from Riga, which could lead to lower prices, while now this has changed.

The volume of transactions

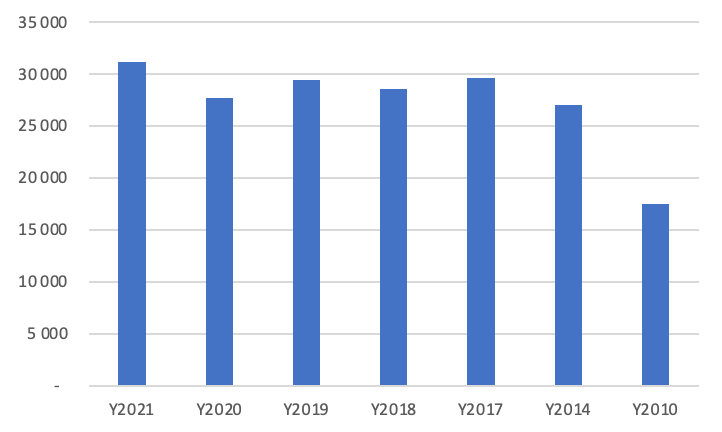

The year 2021 seems to be a record year for residential properties (incl. land plots) with 31,153 transactions. For comparison, back in 2010 (after the financial crisis), the amount was 17,434, while the year 2014 figure was pretty much in line with the next 7 years.

Based on this data, I think that it can be said that the number of transactions is in line with the last 5-year numbers & there are no major deviations.

Regional factors

In short - same as with transaction volume, there is no deviation from the mean for the regional factor. During the last 10 years, around 50% - 55% of the deals took place around Riga & it’s the same now. To be fair, the proportion was even higher back in 2014.

Conclusion

Across globe:

US housing market is heating up in terms of prices, thus also the average mortgages are at a record high. To make it a double whammy, the interest rates are also raising, thus leading to higher monthly payments.

China’s growth is heavily dependent on the real estate market; however, it is going through multiple challenges - lower sales, some of the more prominent real estate developers struggling & people not paying mortgages for unfinished projects.

Europe of course differs country by country, but it’s noticeable that for most of the markets the wage growth is not keeping up with the housing price increase.

Latvia:

Out of the Baltic states, Lithuania is the only market, where the salaries seem to be keeping up with the higher real estate price tag.

Latvians have the lowest household debt to income across Europe with 31%. *standing ovation*. This means that on average people have not borrowed excessively which is not just good but a significant difference compared to the 2007/2008 period when we peaked at 74%.

In general, it seems that the real estate prices have been raising too quickly & the wages are not keeping up with that. On top of that, inflation is highly elevated & lending interest rates will come into play, thus further decreasing the purchasing power.

Real estate is a long game. Therefore, I don’t believe that this means that prices will just generally drop. Latvian real estate prices should continue to raise together with household income, as we come closer and closer to the pricing in the more developed markets.

Hoooowever, some discounts will be coming, maybe just not yet. There are multiple factors that contributed to the higher housing prices such as (a) increased construction costs, and (b) elevated demand from buyers. Also, an important factor is that lots of capital were available for real estate developers & that capital will become more expensive due to raising the interest rates.

Due to the aforementioned factors, it’s not gonna be that easy to lower the prices or offer discounts without making a loss for the real estate developers. Nevertheless, if the demand vanes, then it’s gonna be the only way to avoid further losses as they have to pay interest to their creditors (investors & banks).

The better projects will still be able to sell for good or at least decent prices, as the demand is still there. At the same time, lower quality or less popular projects will be forced to offer some price cuts.

I can’t promise, but I feel like we gonna look into the construction part of the real estate market next.

I’m writing this to guide myself through the current events & I hope that I will manage to help others by doing that.

As usual, I am more than interested in your thoughts.