Inflation update - is the worst behind us?

Has the inflation peaked? Did you cry slightly when getting the latest utility bill? & happy to announce that our favourite Latvian, Matīss, is back with his personal finance update!

🥹 Worry not my friends - I am back!

soo... what up? It’s 2023 & the world is still spinning!

Did you already start missing our lovely get-togethers? Pardon me, but I have been busy with my new friend which takes a lot of my time - chatGPT. Nonetheless, no excuses, so I promise to be more active & post around once a month from now on.

Main topics for this time:

what has happened with our buddies - inflation, interest rates & our purchasing power in general?

is the worst behind us? or are we just playin' for now?

observations & speculations

🎙️ Behold - one of the paragraphs will be written by our very own - chatGPT, let’s see whether you can guess which.

🐯 Life of Matīss

A guy who portrays a bit of each of us - imperfect, yet gives his best, optimistic, yet can eat a whole pack of ice cream after a bad day at the office, hopeful, yet doubts that he will have a +1 to his Christmas party. That is our boy - Matīss!

What did we expect & what has actually happened?

As it turns out - real life is even more pessimistic than was I. That’s a relief.

Latvian inflation remains sizzling hot - at 20.8% year-over-year (YoY) in December. That’s by comparing with December 2021 which already was kind of inflated. If we compare it to December 2020, then inflation sits at 30.4%. Main drivers:

Heating (gas) - 100% YoY, 160% compared to Y2020

Electricity - 22.9% YoY, 63% compared to Y2020

Car fuel - 17.9% (!!!) YoY, 53.6% compared to Y2020 - this one is actually interesting. It’s below average & it peaked at 44.4% YoY in June, meaning that new factors, not fuel prices now drive the overall inflation.

6-month Euribor (that’s your bank loan’s variable component) is already at the highest level since Y2008 when it peaked at 5.4%.

I have some good news as well - Euro has been outperforming U.S. Dollar. The EUR/USD rate (1.09) is up more than 10% since the end of summer 👯♀️

Matīss financial update

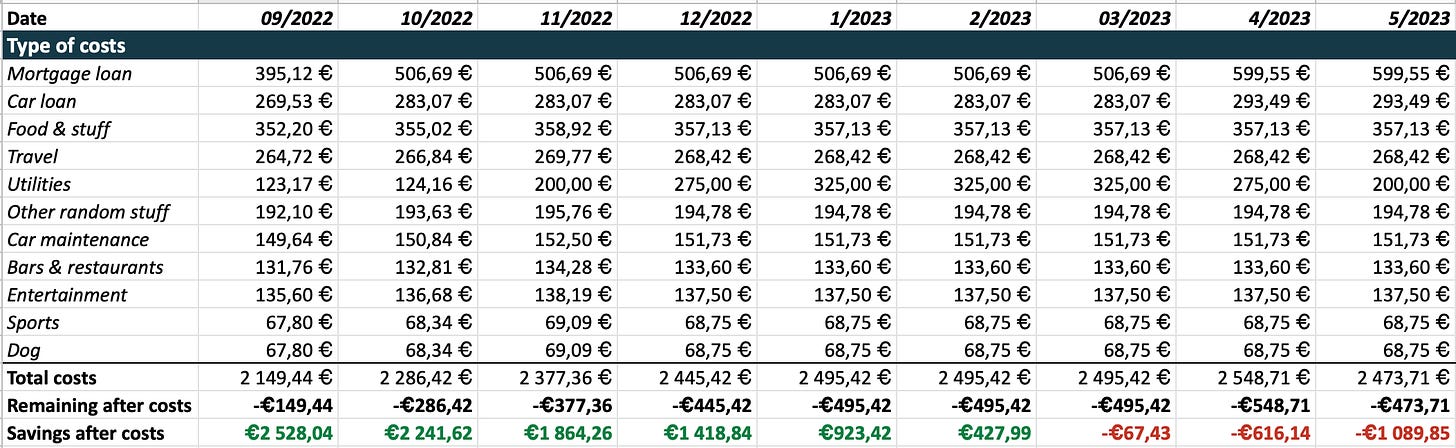

See the table below to have an approximate representation of Matīs’s latest monthly results & a forecast for the next few months. I am (a) assuming that his loans have a 6-month Euribor that is being updated to 2% on October 2022 & then to 3.5% on April 2023, (b) adjusting his Utilities to seasonality.

To sum it up - long gone are the times when Matīss could have invested 10% of his salary. Now his savings are like fairy dust & gone by early Spring if he is not changing his spending habits. What about you?

🔮 My very personal short-term expectations

I ain't no crystal ball, I can't predict the future. Always do your own research & consider these just as predictions and nothing more.

Inflation is sticky & it should be assumed that it will stay high for the foreseeable future. As mentioned, fuel prices have dropped but it is not a certainty that they will stay low. Services inflation (the stickiest of them all) is just picking up from 7% at the end of summer to around 11% by the end of the year. Have you ever encountered that your hairdresser’s fees suddenly become lower? Neither have I.

I believe that it is wise to live with an idea that interest rates (read your borrowing costs) are unlikely to fall in 2023 & maybe even 2024. Europe & European Central Bank (the ECB) are the followers, not the leaders with the alpha dog being the United States of America (U.S.). The U.S. FED’s (their central bank) interest rates are around 5% already & expected to go even slightly higher. & to quote remarks of the ECB President Legarde:

“We shall stay the course until such a time when we have moved into restrictive territory for long enough so that we can return inflation to 2% in a timely manner.”

However, markets are wildin’, S&P500 & Nasdaq are up 6% and 11%, respectively, year to date. I do not believe that this is sustainable for the time being & it feels like driven by “good-vibes only“ sort of thinking, but I just might do a deep dive into the topic for the next time. A couple of things though:

FED rates have not even peaked yet (90% probability) & historically speaking (if we assume any kind of recession) it means that the market has not bottomed

even though there are a lot of layoffs for large tech companies, unemployment remains at record lows & one of the FED’s goals is to decrease the purchasing power and subsequently also the inflation. I know it is harsh, but that’s just how it works. This week, on the 1st of February, the FED chairman will speak & give more insights into their thinking.

company earnings have not been hit yet & it will happen (69% probability) due to the decrease in consumer purchasing power (see the illustration of Matiss above). I will also give an example in the last part of this post of how this impacts businesses out there.

This is a somewhat precise visualization of myself when writing the stuff above, so roughly around 70% of confidence:

My other 30% goes for a scenario where Central Banks decide to be the good guys & start bringing down the rates already by mid-2023. Then the US restarts the money printing business later this year. Why? The year 2024 is the election year for the US presidency & Biden will not want to run for his second term during a recession that started under his term.

📜 To make a long story short

I will finish with a simple, yet hopefully powerful example of the impact created by the inflated prices & elevated interest rates on some businesses.

Storytime

Nikolajs, a friend of Matīss, owns a small business called "Koļakao 🍫" that sells homemade chocolate bars.

He has 3 employees, a small factory, and a loan for new equipment.

The company has been generating a net profit of €4,000 for the past 6 months, with monthly costs of €17,000 and average revenue of €21,000. They even have saved up to €15,000 in the bank.

Starting from the beginning of autumn, Nikolajs business is facing two challenges at the same time (1) cost increase due to inflation & (2) smaller demand due to the decrease in consumer purchasing power.

Looking ahead, the costs (production, raw materials, utilities, bank loan) are increasing by 18% to €20,000, while the demand decreasing by 20% or €4,200 to €16,800, resulting in a monthly loss of €3,200 and less than 5 months of runway for the business.

Nikolajs with the team of “Koļakao” are faced with a tough decision - (a) cut production or other costs or (b) raise the prices. Production cuts could mean lower salaries to all employees or 1 would have to go, while higher prices could mean even lower demand.

There are many larger & smaller “Koļakaos“ out there & each one of them is contributing to the economy as a whole by (a) paying salaries that are later used to pay for other goods & services, (b) paying to partners that deliver all the goods necessary to produce & package the tasty chocolate bars that are also paying salaries to their employees & that are later paying for goods & services, (c) and so on & on.

Imagine if Matīss would have a salary cut, while already overspending. That would be tough & that’s why he has decided to cut back on his costs. Be like Matīss.

If you want to play around with your personal case, then feel free to get to know my “Tacklin the inflation“ game where you will see how everything comes together for you & whether you should change something about your spending habits for the next month to come.

I will leave you with a lovely song! See you next time & let’s POWER through this! 🏋️